Gold has always had a reputation as the ultimate safe-haven asset, but what’s happening now is different. Investors aren’t just buying gold as a hedge — they’re piling into it with urgency. With gold prices hitting record highs and momentum accelerating, the metal is sending a loud message about the state of the global financial system.

So why is gold suddenly back at the center of the investment world? The answer lies in a powerful mix of economic uncertainty, shifting monetary policy, geopolitical tension, and a growing loss of confidence in traditional assets.

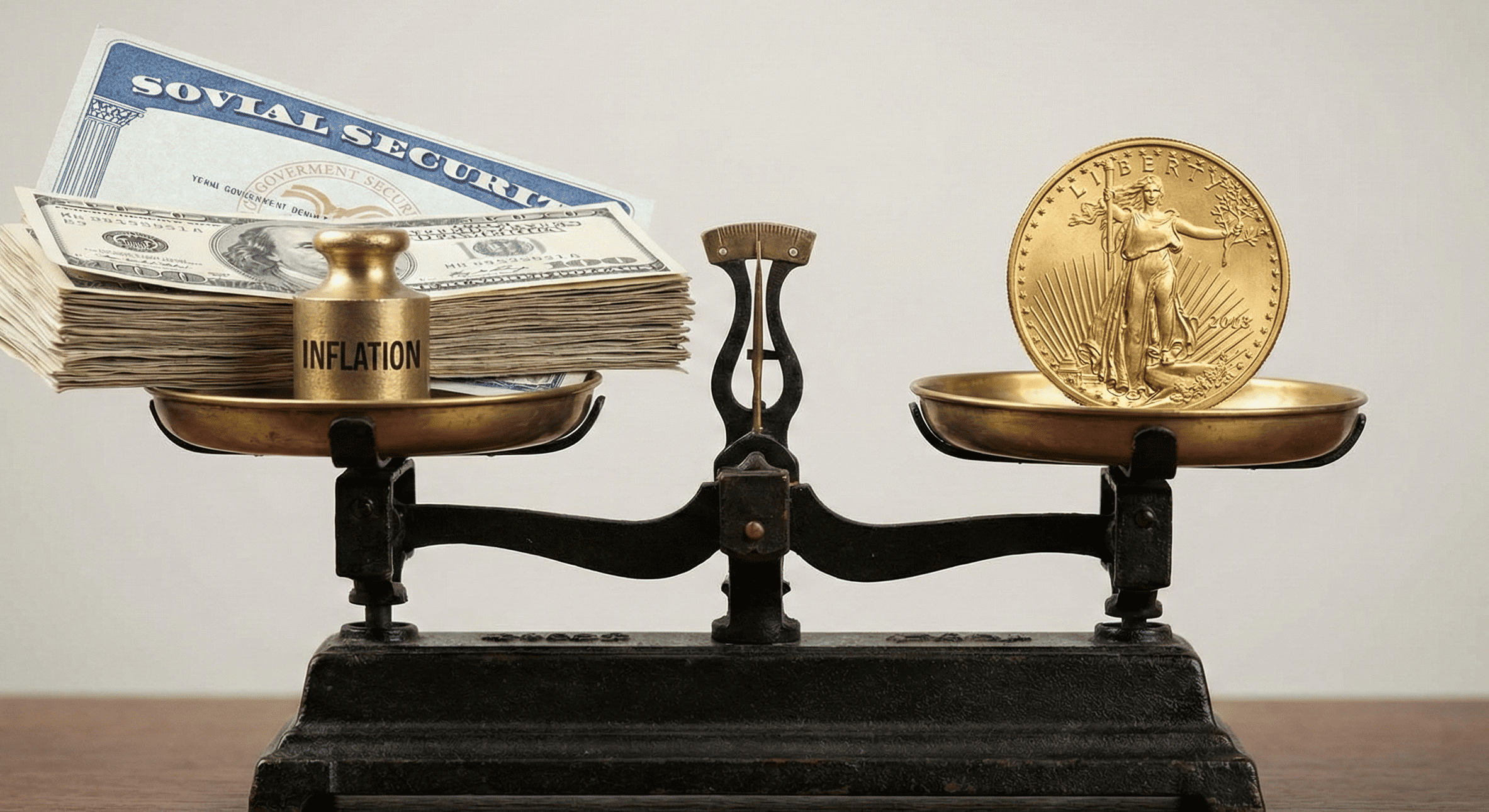

A Crisis of Confidence in Paper Money

At the heart of gold’s surge is a growing distrust in fiat currencies. Over the past decade, governments and central banks have printed money at unprecedented levels. While this helped stabilize economies in the short term, it has also raised serious long-term concerns about currency debasement.

Inflation may fluctuate month to month, but the underlying fear remains: paper money loses purchasing power over time. Gold, by contrast, cannot be printed, diluted, or manipulated in the same way. For many investors, that makes it the ultimate form of financial insurance.

When trust in currencies weakens, gold thrives — and right now, trust is fragile.

Inflation Isn’t the Only Threat

Even as inflation data shows signs of cooling in some regions, investors are not convinced the danger has passed. Real interest rates — returns after inflation — remain unattractive in many markets. That means cash and bonds often fail to preserve wealth.

Gold doesn’t generate yield, but when traditional “safe” assets stop doing their job, gold suddenly looks far more appealing. Investors aren’t buying gold to get rich overnight; they’re buying it to avoid getting poorer.

Also read- Brutal Market Rout: Gold and Silver Prices Collapse in an Exceptionally Volatile Session

Central Banks Are Leading the Charge

One of the strongest signals behind gold’s rise is aggressive central bank buying. Major economies have been quietly increasing their gold reserves, reducing reliance on foreign currencies and the U.S. dollar.

This trend isn’t speculative — it’s strategic. Central banks see gold as a neutral, politically independent asset that holds value during economic realignments. When the institutions that print money are buying gold, investors tend to pay attention.

Their actions suggest a long-term shift in how nations think about reserves, risk, and monetary stability.

Geopolitical Tensions Are Fueling Demand

From ongoing wars to trade disputes and rising global polarization, geopolitical risk is no longer a background concern — it’s a daily reality. Markets hate uncertainty, and gold feeds on it.

Whenever global tensions rise, investors look for assets that are outside the financial system, not dependent on any single government or economy. Gold fits that role perfectly. It has no counterparty risk and no political allegiance.

In times of conflict, gold isn’t just an investment — it’s protection.

Stock Market Valuations Are Raising Eyebrows

Equity markets have delivered strong returns in recent years, but many investors believe valuations are stretched. Tech stocks dominate indices, debt levels are high, and market gains are increasingly concentrated.

Gold offers diversification when portfolios feel overexposed to risk. Even investors who remain bullish on stocks are adding gold as a hedge — not because they expect markets to collapse tomorrow, but because they want balance in an increasingly fragile environment.

Fear of Systemic Risk Is Growing

Banking stress, rising government debt, and concerns about financial contagion have not disappeared — they’ve just gone quiet. Investors remember how quickly confidence can evaporate.

Gold shines brightest when people worry about the system itself, not just market cycles. It is one of the few assets that doesn’t rely on promises, policies, or solvency.

When uncertainty moves from “possible” to “plausible,” gold demand accelerates.

Gold Is More Than a Trade — It’s a Signal

The surge in gold prices isn’t just about returns. It’s a reflection of how investors feel about the future. Confidence is cautious. Risk tolerance is shrinking. Long-term stability feels less guaranteed than it once did.

Gold doesn’t lie — it reacts to fear, distrust, and transition. When investors pile into gold like never before, it often means they are preparing, not panicking.

Final Thoughts

Gold’s historic run isn’t driven by hype or speculation alone. It’s being fueled by deep structural concerns about money, markets, and global stability. Investors aren’t abandoning stocks or bonds entirely — they’re acknowledging that the rules are changing.

In uncertain times, gold reclaims its ancient role as a store of value. And judging by current demand, many believe this uncertainty is far from over.