Gold Exchange-Traded Funds (ETFs) allow investors to gain exposure to gold without physically owning it. Instead of buying gold bars or coins, investors can purchase ETF units that track gold prices. When Gold ETF Inflows Just a 6 Months High, it means more money is flowing into these gold-backed funds than at any point in the past six months.

This trend usually reflects:

- Rising economic uncertainty

- Inflation concerns

- Currency volatility

- Geopolitical tensions

- Stock market corrections

Whenever uncertainty rises, gold becomes attractive. That’s why headlines like Gold ETF Inflows Just a 6 Months High often appear during turbulent periods.

What Is Driving Gold ETF Inflows Just a 6 Months High?

Several macroeconomic factors typically contribute to such inflows:

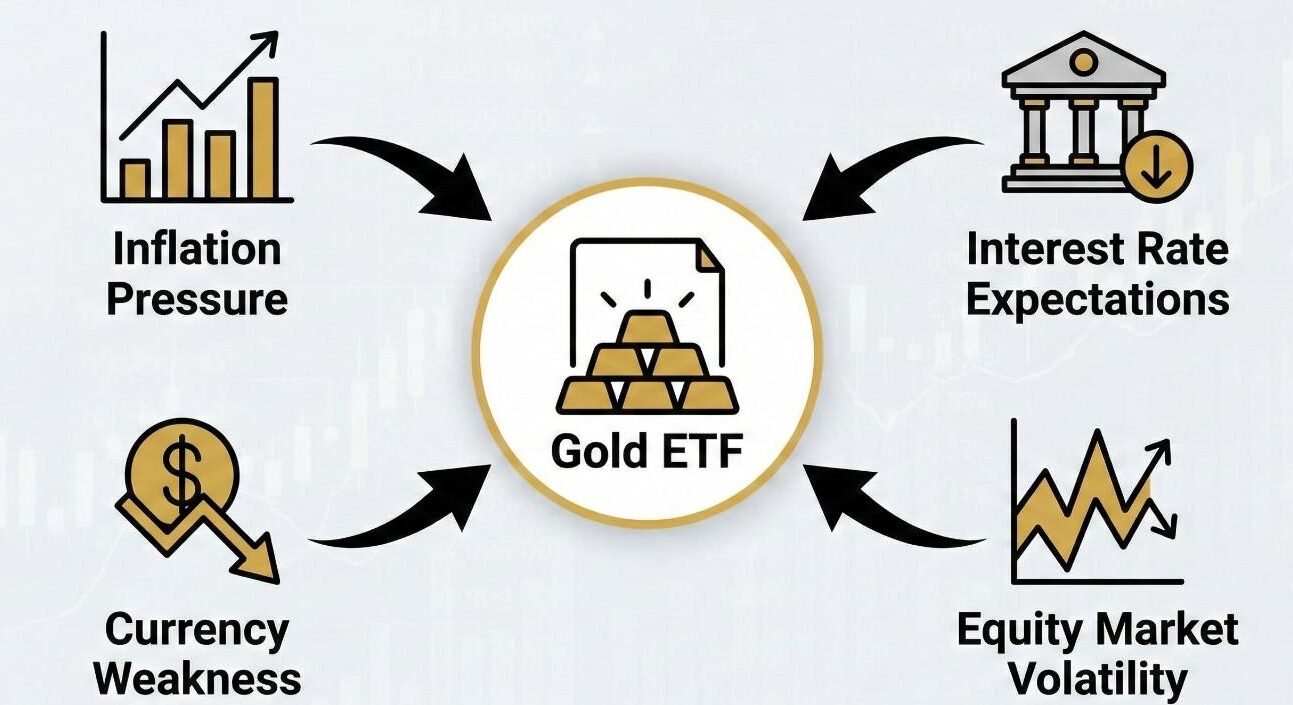

1. Inflation Pressure

When inflation remains elevated, investors look for assets that preserve purchasing power. Gold has historically acted as a hedge against inflation, making ETFs an easy access point.

2. Interest Rate Expectations

If investors believe central banks may slow down rate hikes or even cut rates, gold becomes more attractive. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold.

3. Currency Weakness

A weakening domestic currency often pushes investors toward gold. In countries like India, where gold demand is culturally strong, ETF participation rises quickly during uncertain currency movements.

4. Equity Market Volatility

Stock market swings push investors to diversify. When markets look unstable, headlines such as Gold ETF Inflows Just a 6 Months High start trending because investors are seeking safer alternatives.What Gold ETF Inflows Just a 6 Months High Signals About Investor SentimentWhen Gold ETF Inflows Just a 6 Months High, it reflects a shift in risk appetite. Investors are not necessarily abandoning equities, but they are hedging against downside risk.

This behavior suggests:

- Defensive positioning

- Portfolio rebalancing

- Long-term wealth protection strategies

It’s important to understand that ETF inflows often move ahead of price spikes. That means the smart money could be positioning early before gold prices make a significant breakout.

Also read – Gold and Silver Surge: Why Bargain Buyers Rush Back Into Precious Metals

Is This a Short-Term Rally or Long-Term Trend?

One key question after seeing Gold ETF Inflows Just a 6 Months High is whether this is a temporary spike or the beginning of a sustained uptrend.

Historically, sustained ETF inflows over multiple months often support higher gold prices. However, if inflows slow down quickly, the rally may cool off. Investors should watch:

- Central bank policy decisions

- Inflation data releases

- Global geopolitical developments

- Dollar index movements

If uncertainty continues, the trend of Gold ETF Inflows Just a 6 Months High could extend even further.

Should You Invest After Gold ETF Inflows Just a 6 Months High?

This is where strategy matters.

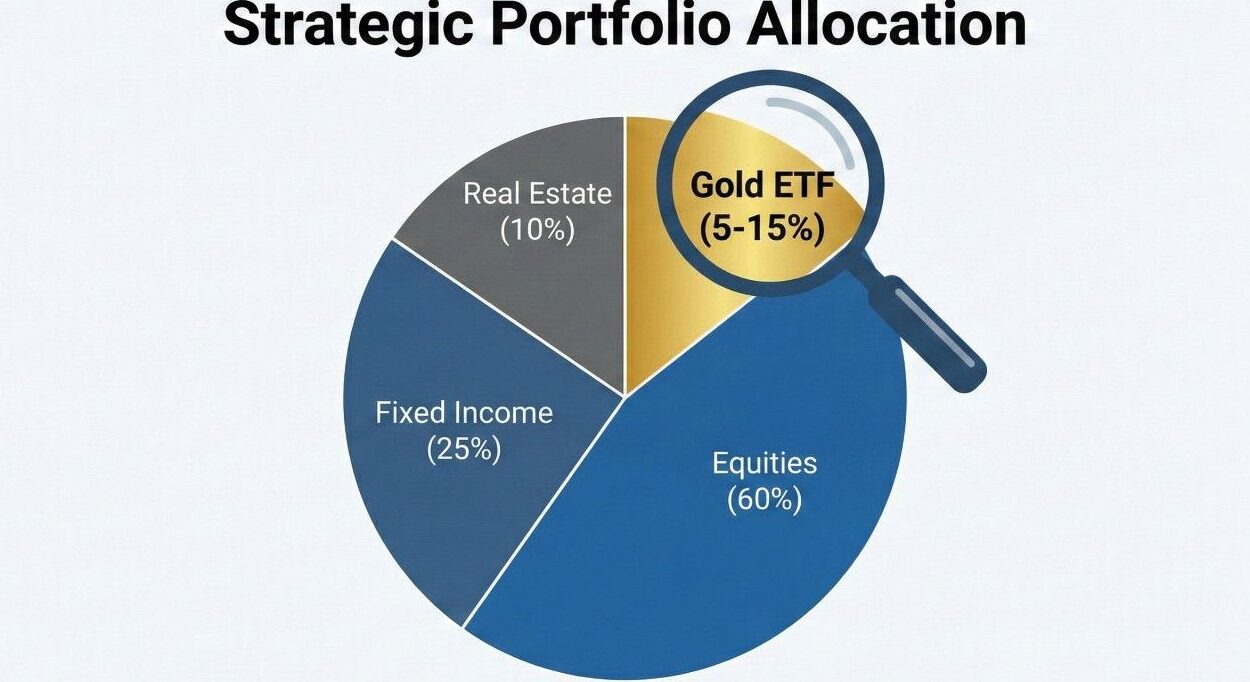

While Gold ETF Inflows Just a 6 Months High indicates strong demand, investors should avoid making emotional decisions based solely on headlines. Instead, consider:

- Your risk tolerance

- Portfolio allocation balance

- Long-term investment goals

- Entry timing and diversification

Financial experts often recommend allocating 5%–15% of a diversified portfolio to gold. ETFs make this allocation simple and liquid.

Benefits of Investing in Gold ETFs

If you are considering exposure because Gold ETF Inflows Just a 6 Months High, here are some advantages:

- No storage risk compared to physical gold

- High liquidity

- Transparent pricing

- Lower expense compared to buying jewelry

- Easy buying and selling through stock exchanges

For Indian investors, gold ETFs also eliminate purity concerns and storage hassles.

Risks to Keep in Mind

Even though Gold ETF Inflows Just a 6 Months High, gold is not risk-free. Prices can correct if:

- Inflation cools faster than expected

- Interest rates remain high

- The US dollar strengthens

- Equity markets recover strongly

Gold does not generate income like dividends or interest, so its performance depends largely on price appreciation.

The Bigger Picture Behind Gold ETF Inflows Just a 6 Months High

This surge is more than just numbers—it reflects psychology. Investors are preparing for potential volatility. Whether it’s global economic slowdowns, geopolitical conflicts, or currency instability, gold remains the traditional financial shield.

When you see headlines like Gold ETF Inflows Just a 6 Months High, think of it as a market temperature check. It tells you that caution is rising.

Final Thoughts

The headline Gold ETF Inflows Just a 6 Months High carries weight in the financial world. It signals renewed demand, defensive investing, and growing concerns about economic stability. While this may support gold prices in the near term, smart investors should focus on balanced portfolio strategies rather than chasing momentum.If uncertainty persists, the trend behind Gold ETF Inflows Just a 6 Months High may continue. But as always, disciplined investing, proper diversification, and long-term thinking remain the real keys to financial success.Gold may shine brightest during uncertain times—and right now, that shine is clearly attracting attention.