The global commodities market witnessed a historic and blood-curdling sell-off this Friday, marking what many analysts are calling the end of the “vertical phase” of the precious metals bull run. After weeks of defying gravity with daily record highs, the floor finally gave way. In a session defined by panic selling and liquidation, the financial world watched a brutal market rout: gold and silver prices collapsed in an exceptionally volatile session that erased billions in value in a matter of hours.

The Great Reversal: A Day of Chaos

The trading session began with the remnants of euphoria. Just a day prior, on January 29, gold had touched a breathtaking all-time high near $5,600 per ounce, and silver had breached the $120 per ounce mark, a level unimaginable just a year ago. However, as the Asian markets opened and liquidity flowed into the European session on Friday, the sentiment shifted violently

Also read – 8 Best-Selling Home Business Ideas to Become a Millionaire!

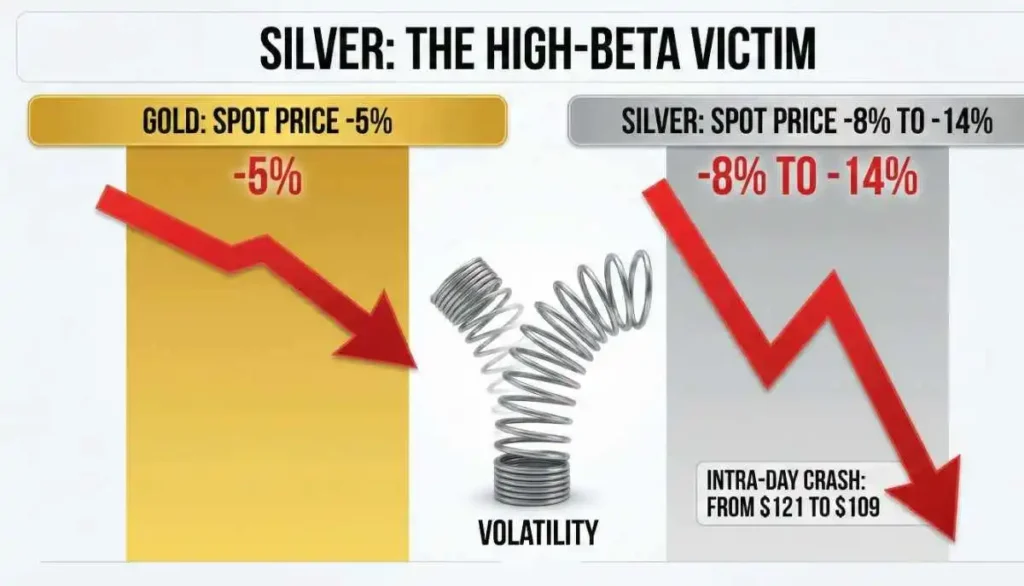

What started as mild profit-taking quickly spiraled into a cascade of automated sell orders. By the time North American traders reached their desks, the brutal market rout: gold and silver prices collapse in an exceptionally volatile session was in full swing. Spot gold plummeted nearly 5%, crashing through key psychological supports to trade around $5,180. Silver, often termed “gold on steroids,” lived up to its volatile reputation, crashing over 8% to 14% intraday, dropping from its $121 peak to hover near $109.

In domestic markets like India, the impact was visceral. On the Multi Commodity Exchange (MCX), gold futures which had neared ₹1,93,000 per 10 grams slumped heavily, while silver futures saw a massive gap-down, wiping out nearly ₹15,000 to ₹40,000 per kg depending on the contract expiry.

Silver: The High-Beta Victim

While gold’s decline was severe, silver’s collapse was catastrophic for late entrants. The white metal is known for its “high beta,” meaning it reacts more aggressively than gold to market swings. During this brutal market rout: gold and silver prices collapse in an exceptionally volatile session, silver wiped out nearly two weeks of gains in six hours.

Industrial demand concerns also played a quiet role. Weak manufacturing data from key zones like the Eurozone hinted that the industrial appetite for silver (used in solar panels and electronics) might not keep pace with the speculative fervor, leading to a “reality check” for prices.

Investor Sentiment: From FOMO to Fear

The psychological toll of Friday’s session cannot be overstated. For weeks, retail investors had been driven by FOMO (Fear Of Missing Out), piling into gold and silver at record highs. The sudden brutal market rout: gold and silver prices collapse in an exceptionally volatile session trapped many of these latecomers.

Social media platforms and trading forums were ablaze with confusion and panic. “Is the bull run over?” was the trending question. Renowned fund manager Ravi Dharamshi commented on the situation, noting that the “near vertical rise in bullion is done” and that the market had “taken every short to the cleaners” on the way up, only to punish the longs on the way down. This sentiment reflects a classic market cycle: the “smart money” exits quietly while the “retail money” is left holding the bag during the crash.

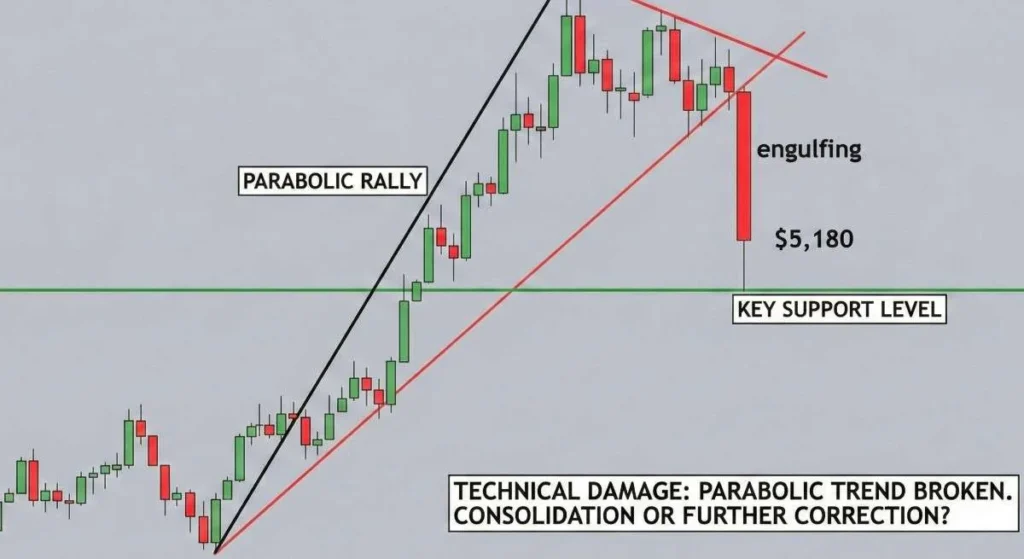

Technical Damage and Future Outlook

Technically, the chart damage is significant but perhaps not fatal to the long-term bull market.Gold: The metal has broken its immediate parabolic trendline. Support is now seen around the $5,000 psychological level. If it holds, this could be a healthy consolidation. If it breaks, a deeper correction toward $4,800 is possible

Silver: The damage here is more acute. Breaking below $110 opens the door to a retest of the $100 breakout level. The “wick” left on the monthly candle is a bearish signal, suggesting that the $120 level may serve as a formidable ceiling for months to come.

However, the fundamental drivers for precious metals—global debt debasement, geopolitical instability, and central bank buying—remain intact. Many analysts view this brutal market rout: gold and silver prices collapse in an exceptionally volatile session as a “cleansing” event that removed excessive froth from the market.

Conclusion: A Warning Shot

The events of January 30, 2026, serve as a stark reminder of the risks inherent in parabolic markets. While gold and silver remain timeless stores of value, they are not immune to the laws of gravity. This brutal market rout: gold and silver prices collapse in an exceptionally volatile session will likely be remembered as the day the 2026 frenzy hit a wall.

For investors, the lesson is clear: volatility cuts both ways. While the long-term thesis for metals may still hold, the days of easy, vertical gains are likely over, replaced by a more grind-it-out, volatile trading environment. Caution is now the watchword.